Career Development and Field Work Term

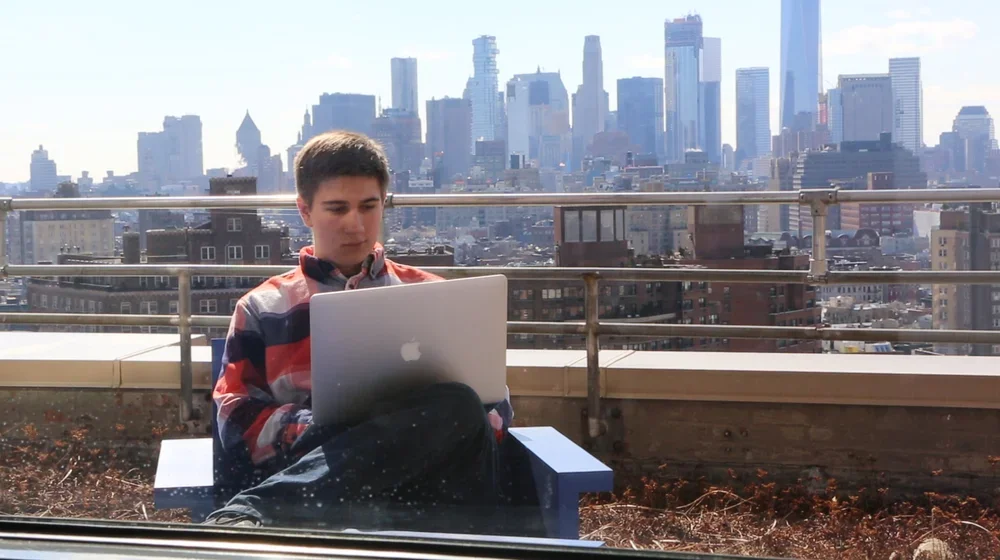

Hone your ideas in the classroom, and test them through hands-on work in the world—every year.

The Career Development and Field Work Term Office supports Bennington's diverse student body in pursuing lifelong career development through individualized advising appointments, field work experiences, and more.

Career Development

With the support of the Career Development and Field Work Term Office, students have the opportunity to shape and adapt their career path through exploration, introspection, and action. Our career advisors assist students with the following activities:

- Discovering their meaning and purpose through career exploration

- Gaining understanding of work environments that fit their beliefs, interests, and ambitions

- Building a network of individuals who can assist in their learning and development

- Identifying Field Work Term, student employment, and post-graduate experiences

- Showcasing their skills and experiences through various forms of professional communication

- Developing the confidence to make informed decisions after leaving Bennington

Current Students, access our comprehensive collection of career development resources (make sure you are logged into a bennington.edu email account).

Field Work Term: Real-world Learning Experiences Every Year

At Bennington, we understand that deep learning requires a sustained mix of classroom time and real-world experiences that build over four years. Through our nearly 100-year-old Field Work Term program, each student completes a six-week field experience every year. These high-impact learning experiences allow students to enhance classroom learning, build professional competencies, clarify career goals, and develop confidence to succeed in the world of work. This is one reason Bennington graduates earn such high marks from employers: they are truly experienced by the time they graduate and have built a valuable resume as well as earning a degree.

With support from the Career Development and Field Work Term office and academic advisors, students choose from a broad array of experiences to fulfill their annual field work requirement such as

- internships,

- fellowships,

- apprenticeships,

- community engagement, or

- independent research.

Current students: learn everything you need to know about Field Work Term.

- The Associated Press

- ABC News

- Time Magazine

- Alvin Ailey American Dance Theatre

- Sony Interactive Entertainment

- Guggenheim

- American Museum of Natural History

- The Bronx Museum

- The Dalton School

- Ennead Architects

- The Fresh Air Fund

- GROW NYC

- HarperCollins Publishers

- Harvard Stem Cell Institute

- International Rescue Committee

- Mark Morris Dance Group

- MASS MoCA

- Museum of the Moving Image

- The Nature Conservancy

- Sundance Institute

- University of California, Riverside, Brain Game Center

- Yale School of Medicine

Student Employment

Student employment is more than just a job—it's an integral part of the educational experience, allowing students to work with a wide range of professional staff in campus departments and community settings. Students contribute to the growth and maintenance of the Bennington community while gaining valuable work experience and developing career readiness skills.

Current Students, get more information about campus jobs. (make sure you are logged into a bennington.edu email account).

Contact Us

- fwt@bennington.edu

- 802-440-4321

- Follow us on Instagram

- Schedule a career counseling appointment or drop by Barn 112

- Come by our weekly drop-in hours